UK to release fiscal plan and OBR forecast on October 31

Just now: Kwasi Kwarteng has brought forward the date of his medium-term fiscal plan to October 31, in which he will lay out the government’s debt reduction plan.

The Prime Minister announced the change in a letter to the Parliamentary Treasury Select Committee.

An independent economic forecast from the Office for Budget Responsibility will also be released on the same day.

The mid-term plan was due to take place on November 23, but Kwarteng is under increasing pressure to present his plan as soon as possible.

key event

filter Beta

Full text: Kwasi Kwarteng to launch debt relief program on October 31

Richard Partington

Kwasi Kwarteng will bring forward the date of the debt-cutting plan to October 31 after MPs put pressure on unfunded tax and spending pledges announced in last month’s small budget, My colleague Richard Partington wrote.

The chancellor told the Commons Treasury Select Committee he would use the new dates to announce his “medium-term fiscal plan”, along with new forecasts for the economy and public finances from the Office for Budget Responsibility.

The plan to bring the date forward from Nov. 23 comes after financial market turmoil after Kwarteng last month pledged more than £40bn in unfunded tax giveaways aimed primarily at middle- and upper-income earners. OBR was excluded from his previous tax and spending activities.

Kwarteng told Finance Committee chairman Mel Stride that he hoped the “short additional delay” in publishing the OBR forecast would be acceptable.

It’s been a busy morning with:

But despite this two-pronged approach, government bond prices remained weak and the pound was little changed.

Susannah StreetSenior Investment and Market Analyst Hargreaves Lansdown,Say:

Clearly, as Kwasi Kwarteng prepares to head to the IMF’s annual meeting, where his policies are under fresh scrutiny, skepticism remains about the government’s plans.

All eyes will be on an independent assessment of his spending plans, and the risk is that if the numbers don’t add up, the market could be spooked again on Halloween. ”

This is Professor Paul Krugman who won 2008 Nobel Prize in Economics, About this year’s winners:

Now this is a prize that many of us will be delighted to see. Groundwork with huge practical implications – may even outweigh the consequences of monetary tightening and soaring dollar sparking more crises 1/ https://t.co/RNfDDq9Ore

— Paul Krugman (@paulkrugman) October 10, 2022

Back in 2010, I wrote: “I really like Diamond-Dybvig — that is, I think about financial crises in terms of the Diamond-Dybvig model of bank runs.” 2/ https://t.co/cUmcsY4Z3f

— Paul Krugman (@paulkrugman) October 10, 2022

Nobel Prize in Economics awarded to Bernanke, Diamond and Debwig

Just now: A former top U.S. central banker has won some of the top prizes in economics.

American Economist Book Bernanke, Douglas diamond and Philip Dybvig Received the Riksbank Prize for Economic Sciences in memory of Alfred Nobel for his research on banking and financial crises.

They will share SEK 10 million (£800,000).

diamond and Dybvig Recognized for its work on how banks are vulnerable to rumours about their impending collapse.

The Royal Swedish Academy of Sciences says:

If a large number of depositors run to the bank to withdraw money at the same time, the rumor can become a self-fulfilling prophecy – a run occurs and the bank fails. These dangerous dynamics can be prevented by governments providing deposit insurance and acting as lender of last resort for banks.

Ben Bernanke Shared this award for his academic work analyzing the Great Depression of the 1930s, the worst economic crisis in modern history. That expertise helped Bernanke through the 2008 financial crisis, when he led the Federal Reserve.

The citation explains:

Among other things, he shows how a bank run can be the determining factor in how deep and persistent a crisis has become. When banks fail, valuable information about borrowers is lost and cannot be quickly rebuilt.

Society’s ability to channel savings into productive investment is thus severely impaired.

BREAKING NEWS:

The Royal Swedish Academy of Sciences has decided to award the Riksbank’s Economic Science Prize 2022 to Ben S. Bernanke, Douglas W. Diamond and Philip H. Davig for “research on banking and financial crises.”#nobel prize pic.twitter.com/cW0sLFh2sj— Nobel Prize (@NobelPrize) October 10, 2022

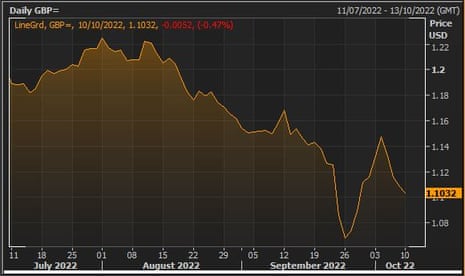

Sterling has recovered some of its previous losses after Kwasi Kwarteng brought forward the date of his debt relief plan.

Sterling was almost flat on the day at $1.107.

There hasn’t been much financial response as the chancellor is expected to present the medium-term fiscal plan earlier…

…though there will be chaos on November 23 after he told GB News last week.

Politics Live: DWP minister hints, trusses set for welfare drop

Kwarteng’s decision to bring forward the medium-term fiscal plan by more than three weeks was prompted by pressure from MPs and financial markets.

Some Conservative MPs have also been fighting the idea that benefits may only increase with incomes rather than prices, after the 45p top tax rate was mandated.

Earlier this morning, Victoria Prentice The Minister for Work and Pensions has strongly suggested that Truss is backing down and bowing to demands from Tory parties who want benefits to be raised in line with inflation.

That would mean a bigger increase in needy households (if wages don’t keep up with inflation).

Speaking to Sky News, Prentice said:

It is very important that we ensure that government resources are directed to the most vulnerable.

Andrew Sparrow’s Political Live Blog with all the details:

Quasi-Quarter told treasury committee In his letter he said:

“After I took office, I received an initial analysis from the OBR, but I have since made important policy announcements including growth plans.

“Importantly, the forecast includes a full and final assessment of the impact of policy measures on the economy and public finances, so it would be inappropriate to publish the preliminary analysis provided by the OBR.

“The new forecast date of 31 October will allow the OBR to capture data releases such as the most recent quarterly national accounts and Blue Book revisions.

“It will allow for a full forecasting process to standards consistent with the legal requirements of the Budget Responsibility Charter enacted by Parliament and provide an in-depth assessment of the economy and public finances.

“This will provide time for finalizing the medium-term fiscal plan. Meanwhile, the Prime Minister and I met with the OBR’s Budget Responsibility Committee on Friday 30 September to discuss the economic and fiscal outlook and we will continue to work closely throughout the forecasting process and beyond. .”

Mel Stride: This could reduce rate hikes

mel step senatorChairman treasury committeewelcomed the decision to bring forward the medium-term fiscal plan to 31 October.

Stride points out that the Bank of England will set the rate in three days – if Kwasi Kwarteng calms the market possible no Need to go up as soon as possible.

BREAKING: Having worked so hard on this, I strongly welcome the @KwasiKwarteng Proposed @OBR_UK Forecast MTFP to October 31st. If this goes well with markets, the Nov. 3 Monetary Policy Committee meeting could result in a smaller rate hike.Crucial to millions of mortgage holders pic.twitter.com/sgn7mB4ovf

— Mel Stride (@MelJStride) October 10, 2022

Unfunded tax cuts in the small budget (totaling more than £40bn) and the lack of a corresponding independent forecast have led to market turmoil, putting more pressure on the chancellor to move faster to determine how the government will pay for the scheme, and what their long-term impact will be.

UK to release fiscal plan and OBR forecast on October 31

Just now: Kwasi Kwarteng has brought forward the date of his medium-term fiscal plan to October 31, in which he will lay out the government’s debt reduction plan.

The Prime Minister announced the change in a letter to the Parliamentary Treasury Select Committee.

An independent economic forecast from the Office for Budget Responsibility will also be released on the same day.

The mid-term plan was due to take place on November 23, but Kwarteng is under increasing pressure to present his plan as soon as possible.

Investor morale in the euro zone fell for a third straight month to levels that portend a deep recession.

The euro zone sentiment index Sentix has fallen to -38.3 points this month from -31.8 in September, the lowest level since the early days of the outbreak in May 2020.

Sentix’s expectations index fell to -41.0 from -37.0, the lowest reading since December 2008 during the financial crisis.

Sentix managing Director Manfred Hubner Say:

At the beginning of October, the sentix economic index indicated that the economic situation in Europe and the world remained grim. The overall euro zone index fell to -38.3 points, its lowest level since May 2020.

Continued uncertainty over winter gas and energy conditions has not diminished due to the attack on the Nord Stream pipeline. In addition to economic concerns, there is now a growing possibility of an escalation of the military conflict in Ukraine. Globally, there is little hope. Only China seems to be stabilizing a bit at the moment.

Sterling fell to its lowest level since late September as the dollar strengthened.

Sterling was down 0.5% at $1.103, below pre-mini budget levels (but still above the all-time low of $1.035 hit two weeks ago).

The Russian ruble has fallen to a three-month low on growing fears that Moscow could escalate the war in Ukraine following its attack on Kyiv this morning.

The ruble fell to 63 per dollar for the first time since early July before recovering slightly.

Shares in energy giant Gazprom started ex-dividend trading as geopolitical tensions rose, exacerbating losses in Russian stocks.denominated in US dollars Real-Time Strategy The index fell 6 percent, while the ruble-based MOEX down 4%.

The sell-off in UK government bonds has picked up pace, with 30-year gilts now over 4.5% – up 16bps (0.16pp) today.